INNOVATION.

DECARBONISATION.

IMPACT.

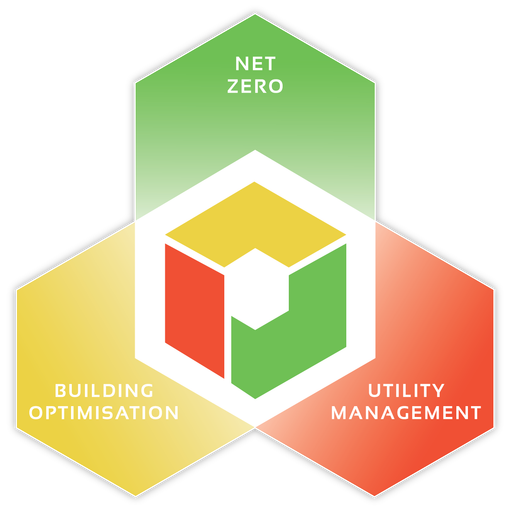

The pieces to the net zero puzzle. Discover your bespoke solution.

LET US HELP YOU DECARBONISE

At Optimised, not only can we advise on your sustainability strategy, but we can implement it too. Through a range of engineering and managed services, we help you reduce your carbon impact, energy costs and consumption.

WHAT DO YOU WANT TO KNOW?

Popular searches: BEMS maintenance, scope 3 emissions, energy trading & risk

LET US HELP WITH YOUR ENERGY MANAGEMENT

We’ve already helped a range of companies develop a net zero strategy and reduce their energy costs. We’re confident we can tailor a solution to your needs and are excited to work with you for the good of the planet.